Calvert Vacation Planning

Dallin asked me to help get them to Europe for a cruise or other vacation. Here are some cards that might help get them there.

Buying the cruise

Each of you can get one of these cards (or both) and cushion the cruise bill a little bit.

Chase Sapphire Reserve

Good: Get 100,000 points ($1500) to use on anything, like a cruise.

Bad: $4000 spend minimum in 3 months ($1,333 per month). If that’s too much then don’t do it. $450 annual fee that can’t be waived in the first year. So you’ll spend $450 upfront just to get the card. There is an automatic $300 travel refund if you spend something on travel with the card (like a cruise ticket). So the card really costs $150.

Chase Sapphire Preferred

Good: Get 50,000 points to use on travel or cash back ($500 worth). $0 annual fee the first year.

Bad: $4000 spend minimum in 3 months ($1,333 per month). If that’s too much then don’t do it. $95 annual fee the 2nd year so you will want to cancel or downgrade in month 11 of having this card.

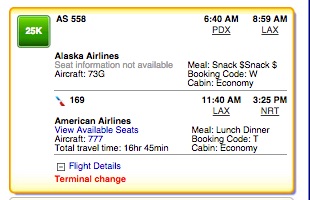

Getting there

Each of you sign up for this card.

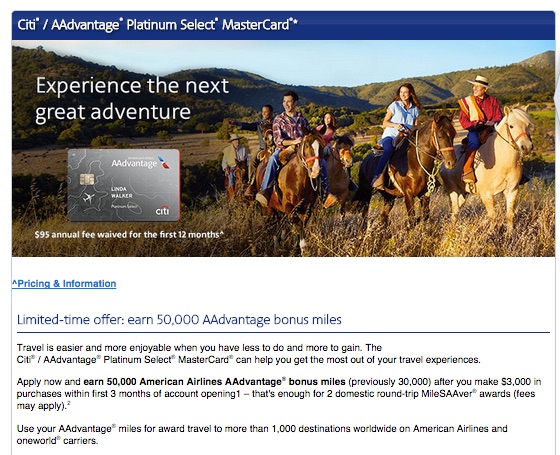

Citi AAdvantage

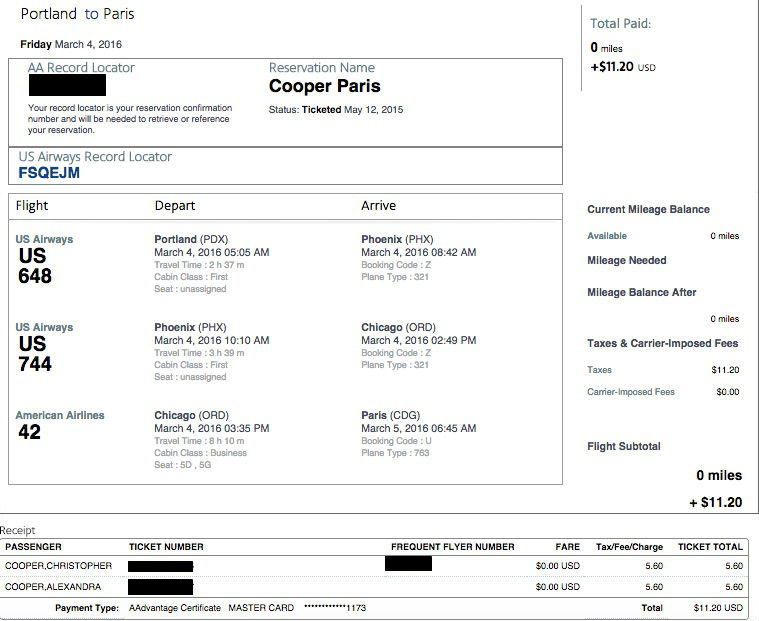

Good: Gives you 50,000 miles for American Airlines. You need 60,000 to fly from SEA (Seattle) to VCE (Venice) roundtrip. $0 annual fee first year. $3000 min spend in 3 months ($1K a month).

Bad: $95 annual fee the 2nd year so you will want to downgrade in month 11 of having this card.

Timeline

Since you would need to hit minimum spends on all these cards before you can do anything, I would follow this timeline.

- Each of you sign up for an American Airlines account. It’s free, you’ll get your mileage number.

- Sign up for a Mint.com account and get familiar with it. You will use this to make sure nothing goes unnoticed with the cards you will be opening.

- Month 1: Dallin signs up for Citi AAdvantage card. All spending goes onto this card.

- Month 3: By end of month 3 you have completed your $3000 spending minimum.

- Month 3/4: Caitlin signs up for Citi AAdvantage card. All spending goes onto this card.

- Month 5/6: You have completed your $3000 spending minimum.

- Month 5/6: Dallin signs up for one of the Chase cards. All spending goes onto this card.

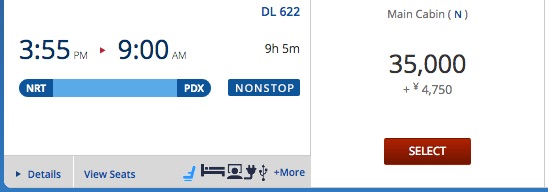

- Month 6: Start looking at cruises and flights. You will want to make sure the cruise and the flight line up of course. You can search using miles at aa.com. You will also want to go in the off-peak season. I think the flights will be cheaper and the vacation will be less crowded.

- Once you find the combo you want, book the flight now. The cruise will be available up to the very end.

- Month 9: You have completed your $4000 spending minimum. You may have put a down payment on the cruise onto this card to help meet your minimum spending.

- Month 9: Caitlin signs up for one of the Chase cards. All spending goes onto this card.

- Month 12: You have completed your $4000 spending minimum. You may have the final payment for the cruise on this card.

Remember the rules

Always pay off the balance before the end of the month. If you paid interest during this thing, you failed. Treat it like a game and play it safe and frugal.